What it means for steel and iron

In a global context increasingly committed to decarbonization, the European Union has taken a decisive step to strengthen its climate policy and protect the competitiveness of its industry. One of the most relevant measures in this regard is the Carbon Border Adjustment Mechanism (CBAM), designed to ensure that Europe’s efforts to reduce emissions are not undermined by the relocation of production to countries with more lenient environmental regulations.

What is CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is the European Union’s new tool to tackle carbon leakage. Its aim is to ensure that imported goods are subject to a carbon price equivalent to that of products manufactured in the EU, where industries must comply with the EU Emissions Trading System (EU ETS).

In short, CBAM levels the playing field: it prevents cheaper, high-carbon imports from undercutting European manufacturers who are already paying for their emissions. It does this by putting a carbon cost on a selected group of imported goods, including steel and iron—a critical focus for the wind energy sector.

Why Steel and Iron Matter in the Wind Industry?

Steel and iron are essential materials in wind energy. They are use in towers, flags, foundations or structural frames and components. These elements represent a large share of the embodied carbon in a wind turbine. As CBAM applies to both raw and semi-finished steel and iron products, it will directly impact the cost structure and supply decisions for many players in the wind sector.

If you want to know if your product is affected by CBAM, you can find the full list of covered goods in Annex I of Regulation (EU) 2023/956. The annex details the product categories by CN code, including specific steel and iron items relevant to the wind industry. Read the official document here (Annex I starts on page 39)

This regulation could shift purchasing decisions toward:

- EU-based suppliers, whose emissions are already priced under the EU ETS

- Low-carbon international producers able to document and certify reduced emissions

- Improved traceability and reporting across global supply chains

Timeline: From Transition to Full Implementation

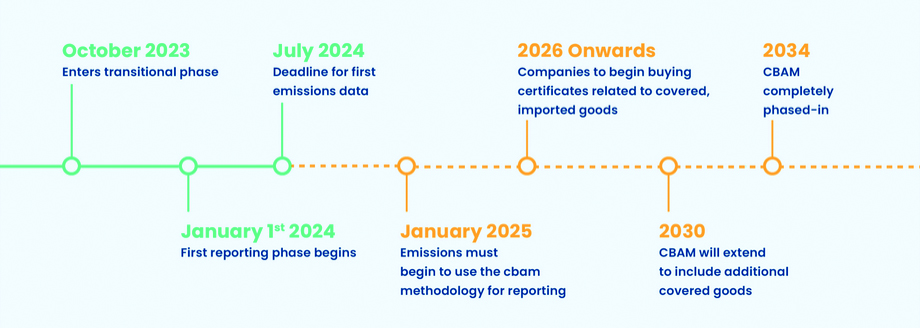

CBAM is being rolled out in phases:

- Transitional Phase (2023–2025):

Importers must report embedded emissions in CBAM goods but do not pay any adjustment yet. - Full Implementation (from January 1, 2026):

Importers will be required to purchase CBAM certificates to cover the emissions associated with their imported products.

How is the CBAM Cost calculated?

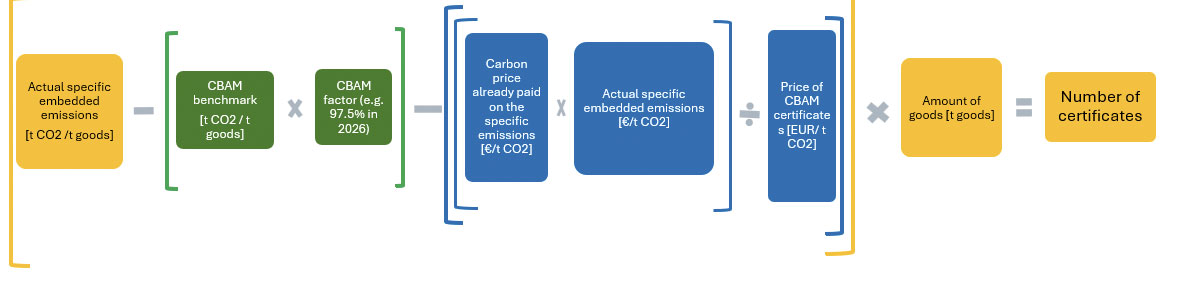

Once fully implemented, the cost of the Carbon Border Adjustment Mechanism (CBAM) will be determined through a multi-step formula that ensures a fair and accurate application of the carbon price to imported goods. The calculation follows this process:

1. Determine the specific embedded emissions

This refers to the actual amount of CO₂ emitted during the production of the imported good, expressed in tonnes of CO₂, per tonne of product.

2. Subtract emissions that would have been covered by free allocation under the EU ETS

These are the emissions that an equivalent EU producer would have received for free under the EU Emissions Trading System. This is calculated as: CBAM Benchmark x CBAM Factor; for example, the CBAM factor will be 97.5% in 2026 and will gradually decrease in subsequent years.

3. Subtract emissions already subject to a carbon price outside the EU

If the product has already been taxed under a carbon pricing mechanism in its country of origin, this amount is deducted using the formula: Carbon price paid x Emissions covered by that price.

4. Apply the CBAM certificate price

The remaining emissions are multiplied by the price of a CBAM certificate, which corresponds to current price of EU ETS allowances (in EUR per tonne of CO₂).

5. Scale by the quantity of goods imported

Finally, the resulting figure is mulplied by the total volume of imported goods to determine the full CBAM cost.

What Are the Risks?

Despite its potential, CBAM also presents challenges:

- Regulatory uncertainty:

As of mid-2025, key aspects such as the benchmarks are still pending final publication. - Complexity in supply chains:

Wind projects involve long lead times and globally distributed procurement. CBAM introduces a new layer of risk and compliance that companies must factor in early. - Administrative burden:

Accurate data collection, verification, and certificate management will require new resources and systems, particularly for importers.

What Opportunities Does CBAM Offer?

While there are risks, CBAM also creates meaningful opportunities:

- Stronger case for low-carbon sourcing:

European or certified green steel becomes more competitive compared to high-carbon imports. - Reinforcement of domestic supply chains:

CBAM supports local industrial resilience and aligns with broader EU goals for climate and economic security.

Where to Find More Information

If your company is involved in importing or using steel and iron components—especially in sectors like wind energy—now is the time to prepare. You can find more information on:

Conclusion

CBAM marks a turning point in how the EU aligns trade with climate policy. For the wind sector—so dependent on steel and iron—this regulation introduces both a cost challenge and a clear opportunity to lead the transition toward a cleaner, fairer industrial landscape.