The Wind Energy Market in India: Opportunities and challenges for Industrial Barranquesa

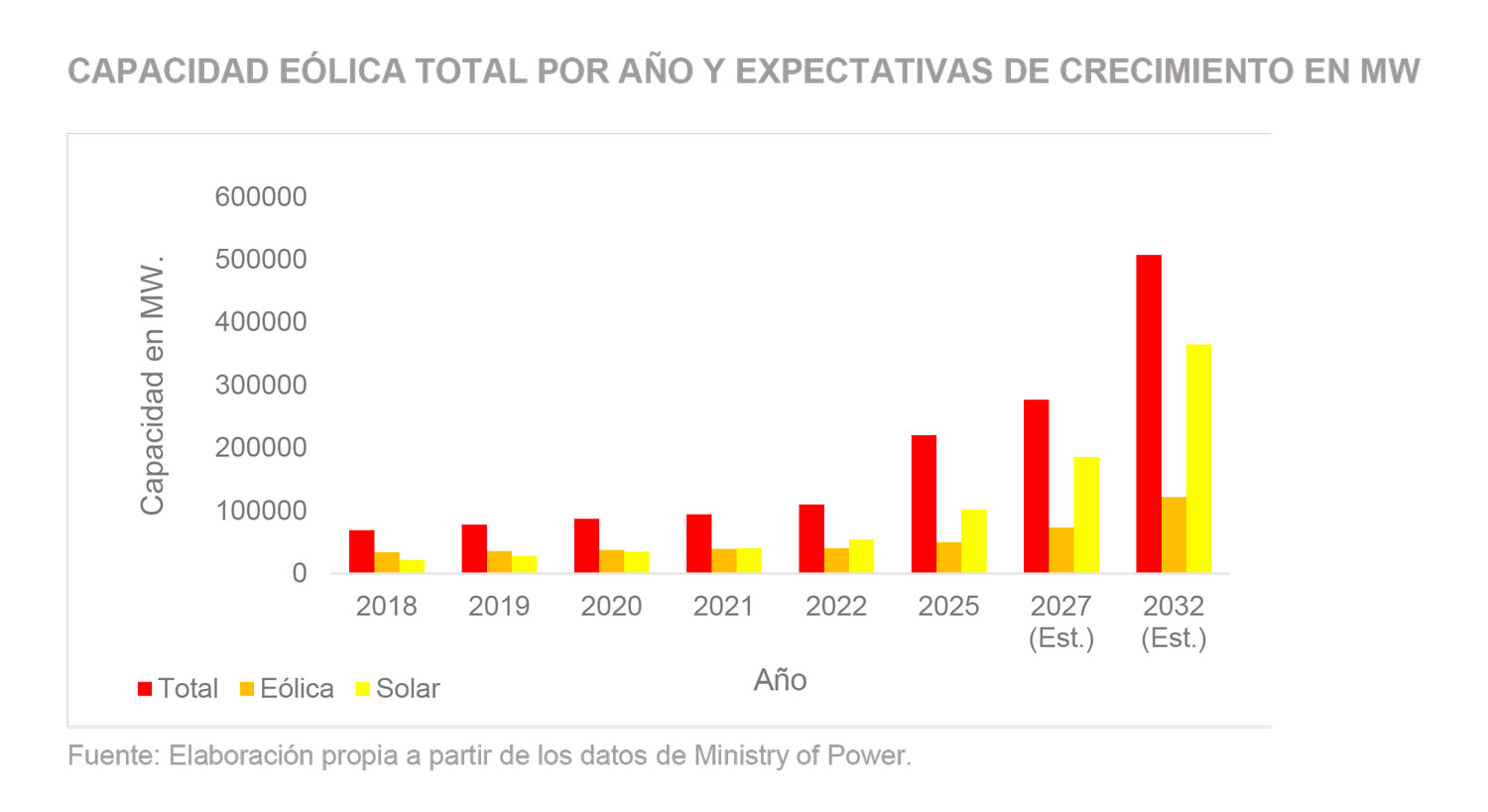

India has established itself as one of the most dynamic countries in the development of renewable energy, particularly in the wind sector. With 51 GW of installed capacity in 2025, the country ranks fourth worldwide, only behind China, the United States, and Germany. This growth has been driven by its significant wind potential, government policies such as Make in India, and the attraction of foreign investment. Forecasts point to strong growth: 73 GW in 2027 and up to 122 GW in 2032.

This is reflected in the findings of the market study carried out by the Economic and Commercial Office in New Delhi, which analyzes the context, opportunities, and challenges of the wind power sector in India.

A market with great potential

The development of India’s wind sector is supported by the aforementioned Make in India policy, wich requires that 80% of the key turbine components– towers, blades, generators, and gearboxes-be manufactured locally. This measure enhance national industrialization, limits imports, and opens the door to manufacturers already established in the country.

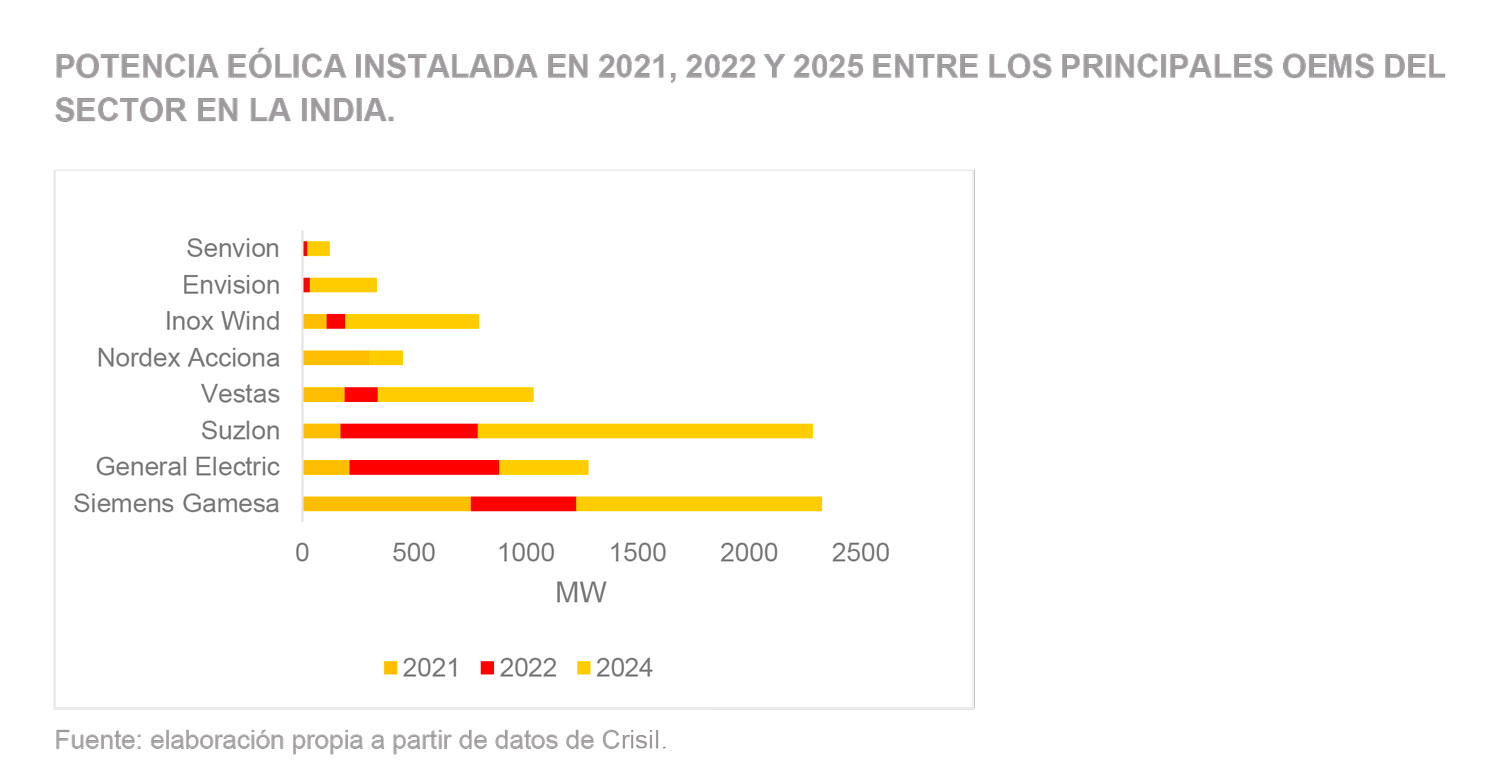

In addition, India has become the second largest turbine assembly hub in Asia-Pacific, with an annual production capacity of 18 GW. However, the pace of new installations is still insufficient to meet targets set in the National Electricity Plan, highlighting the need to accelerate the rollout of projects.

Opportunities for the industry

The study identifies three particularly relevant areas:

- Demand for specialized components

The growth in installed capacity and the local content requirement are generating high demand for parts such as flanges and bolt cages, which are essential in wind turbine manufacturing.

- Component exports

India has consolidated its position as a net exporter of wind components, with key markets in Asia-Pacific, Africa, and Latin America. Its idle industrial capacity allows it to expand its role as an international hub.

- Wind farm repowering

Pioneer states such as Tamil Nadu and Gujarat host parks with older turbines that need to be replaced by modern equipment, creating a growing repowering market.

Challenges to overcome

The environment also presents significant challenges:

- Import restrictions, derived from the Make in India policy.

- High raw material costs, with steel up to 12% more expensive than China.

- Mandatory certification under the standard of the Bureau of Indian Standards (BIS).

- Grid congestion and complexities in land acquisition.

The Spanish presence and the role of Industrial Barranquesa

Spain, in turn, has positioned itself as a reference technology partner for India, with the presence of leading companies in turbine manufacturing, components, and specialized services.

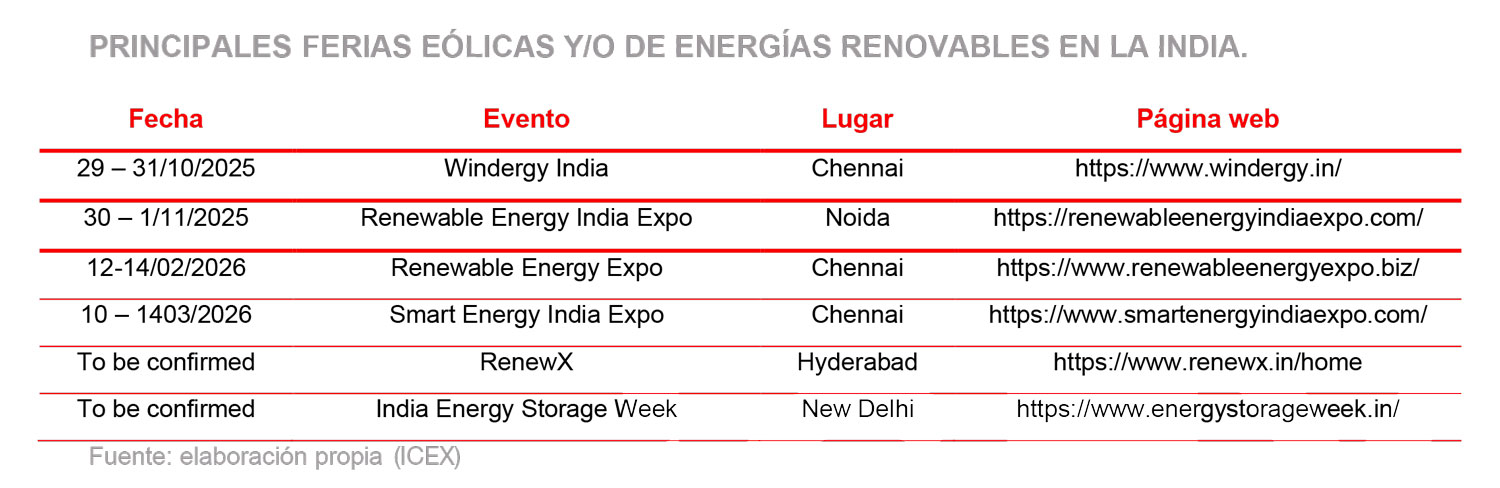

In this context, Industrial Barranquesa has an established physical presence in India, allowing it to meet local content requirements and adapt swiftly to the country’s regulations. We further strengthen our positioning by participating in key trade fairs such as Windergy India 2024 and 2025, within the Spanish pavilion coordinated by ICEX.

Therefore, the Indian wind market represents a strategic opportunity for Industrial Barranquesa, both due to the expected growth in demand for specialized components and the local content requirements. However, success in this market requires regulatory adaptation, supply chain optimization, and the ability to compete in a highly demanding environment.

In short, India is not only a business destination but also a key platform for the international projection of the wind and industrial components sector.

Fuente: Estudio de Mercado de 2025 sobre la energía eólica en India, realizado por ICEX y supervisado por la Oficina Económica y Comercial de la Embajada de España en Nueva Delhi.